alameda county property tax calculator

Alameda County California Property Tax Calculator. Property Tax Rates and Refunds.

How Much Does Your Berkeley Neighbor Pay In Property Taxes See A Map

The system may be temporarily unavailable due to system maintenance and nightly processing.

. To use the Supplemental Tax Estimator. Lookup or pay delinquent prior year taxes for or earlier. If the tax rate in your community has been established at 120 1 base rate plus 20 for prior indebtedness the property tax would be calculated as follows.

1221 Oak Street Room 131. Alameda county property tax calculator Wednesday October 26 2022 Edit. Enter your Home Price and Down Payment in the.

If you have atypical situations or have additional questions about supplemental assessments please call the Assessors Office at 510 272-3787. You can mail in a check and make it payable to Treasurer-Tax Collector Alameda County. A convenience fee of 25 will be charged for a credit card.

There are several ways to pay your property taxes in Alameda County. Alameda County Treasurer-Tax Collector. Alameda County Property Tax Rates.

Many vessel owners will see an increase in their 2022 property tax valuations. The median property tax also known as real estate tax in Alameda County is 399300 per year based on a median home value of 59090000 and a median effective property tax rate of. Tax Analysis Division - Auditor-Controller - Alameda County.

The Alameda County California sales tax is 925 consisting of 600 California state sales tax and 325 Alameda County local sales taxesThe local sales tax consists of a 025 county. Alameda County Sales Tax Rates for 2022. The valuation factors calculated by the State Board of Equalization and.

Orange County California Property Tax Calculator. This generally occurs Sunday. The valuation factors calculated by the State Board of.

Alameda County in California has a tax rate of 925 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in. Alameda County collects on average 068 of a propertys. You can go online to the website of the county government and look.

The mailing address is. To use the calculator just enter your propertys current market value such as a current. Many vessel owners will see an increase in their 2022 property tax valuations.

Dear Alameda County Residents. You can pay online by credit card or by electronic check from your checking or savings account. For comparison the median home value in Alameda County is.

Pay Your Property Taxes Online. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Use this Alameda County California Mortgage Calculator to estimate your monthly mortgage payment including taxes and insurance.

The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900. Georgia Property Tax Calculator. Dear Alameda County Residents.

Property Tax Calculators by County.

Marin County California Property Taxes 2022

San Francisco Property Tax 2022 Ultimate Guide To Sf Property Tax Rates Search Payments Due Dates

Property Tax Calculator Estimator For Real Estate And Homes

.jpg?width=750&name=Untitled%20Design%20(79).jpg)

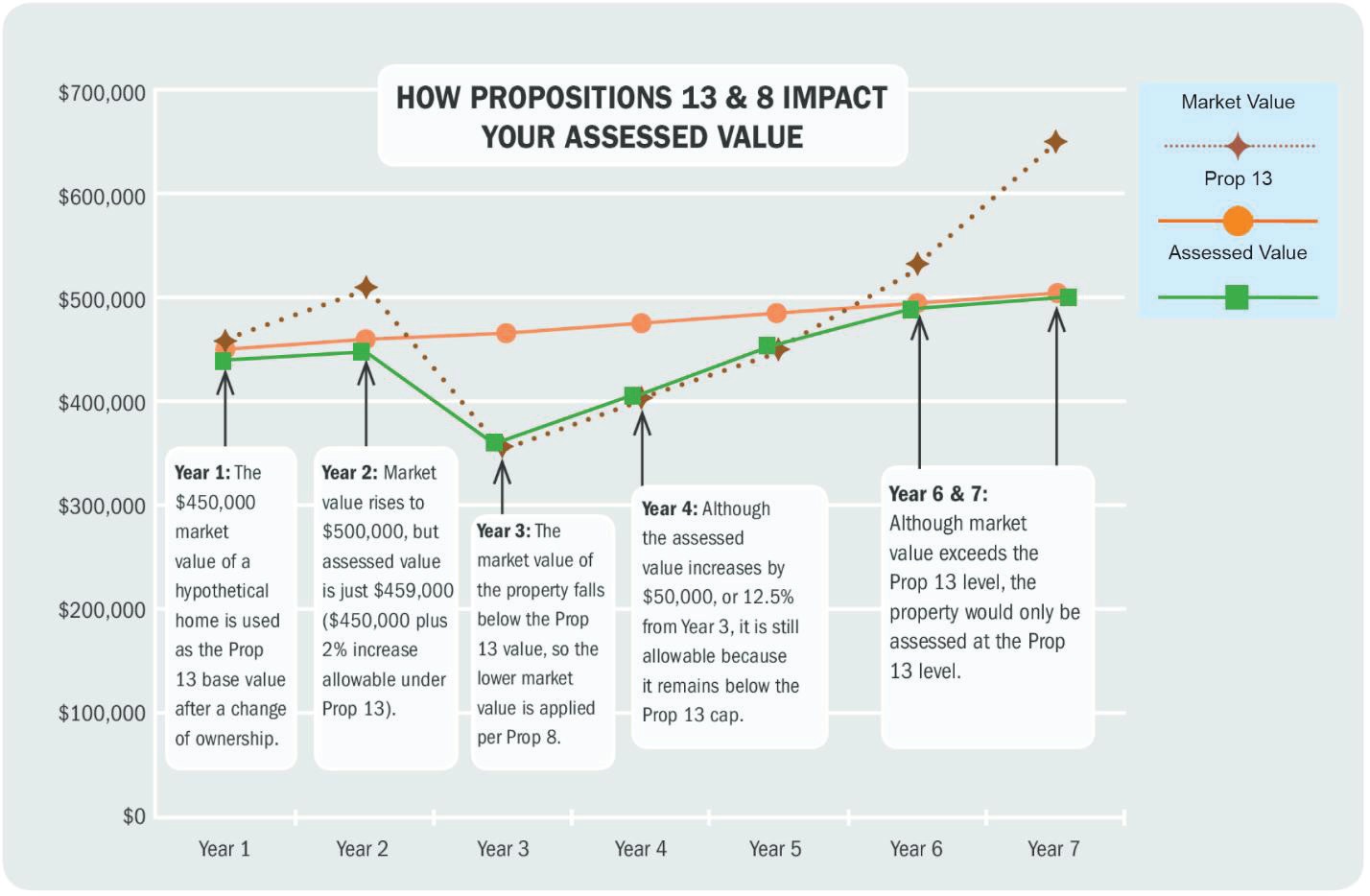

How Do Property Taxes Work In California

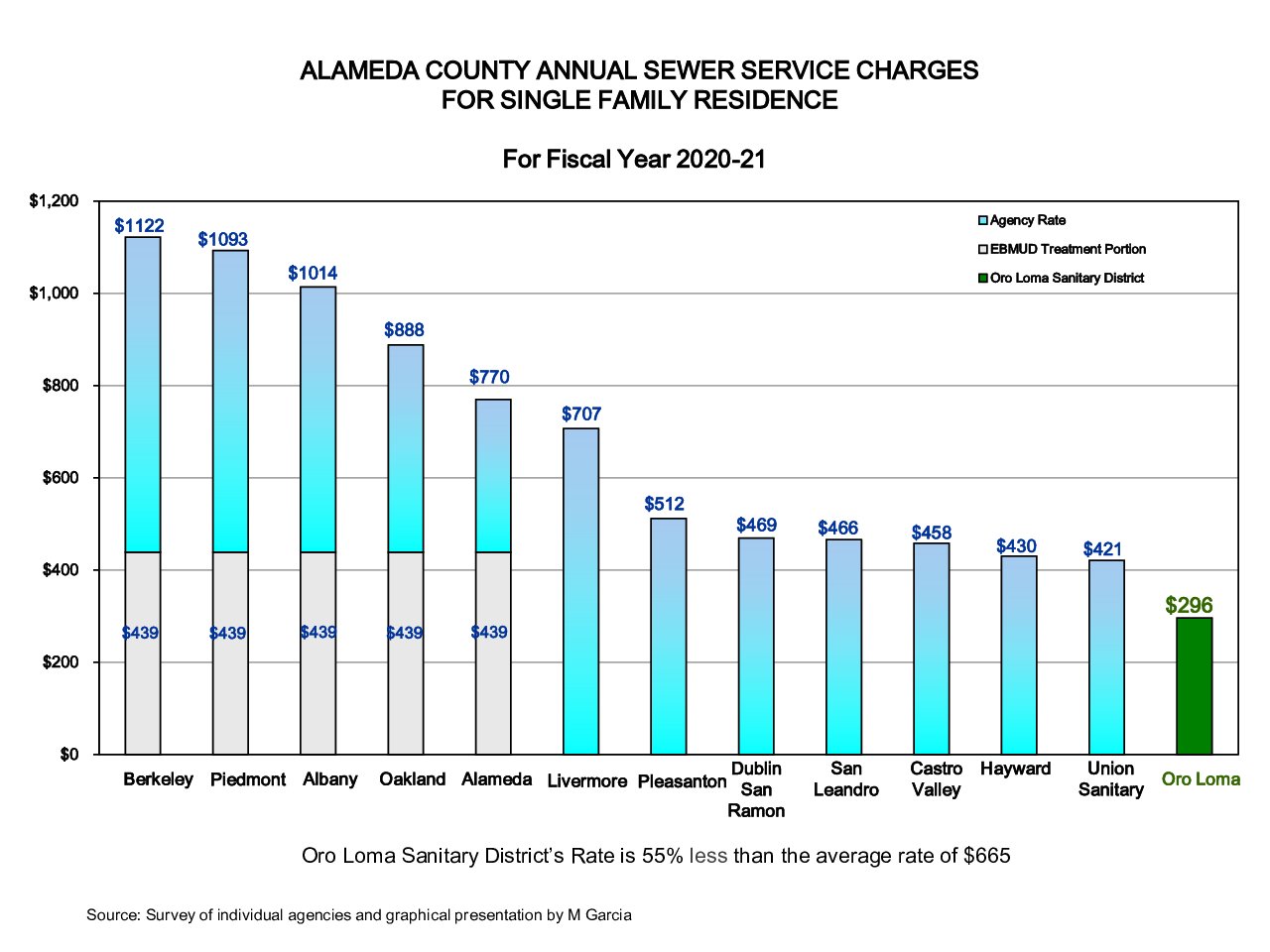

Sewer Service Charges Oro Loma Sanitary District

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Sewer Service Charges Union Sanitary District

California Property Tax Calendar Escrow Of The West

Good News For Homeowners Property Taxes Will Barely Go Up In 2014 The Mercury News

Property Tax Calculator Tax Rates Org

Taxation In California Wikipedia

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Alameda County Ca Property Tax Calculator Smartasset

Alameda County Ca Property Tax Search And Records Propertyshark

Alameda County Property Tax Tax Collector And Assessor In Alameda